Author Archives: Andrew Collier

China’s Bond Rout and the Shadow Market

Summary

Chinese banks have been relying on two sources of credit for liquidity – interbank loans and private loans through the Shadow Banking market. Interbank loans are controlled by bank policies and by the central bank (PBOC). Shadow loans are issued by private creditors. The liquidity crunch over the past week has been blamed by analysts and the media primarily on rising interest rates from the PBOC as it seeks to restrain overall credit, targeted both at excess investment generally and at the property market in particular. This has led to the widespread sale of corporate bonds owned by the banks. According to a senior commercial banker in Beijing, there is a crisis among many financial institutions. “More than 20 securities firms and banks are involved,” the banker noted.

However, the reaction and impact of the private market on bank liquidity has been widely ignored. We think this is a mistake. There is an estimated Rmb30 trillion in private loans sold as investments, called Wealth Management Products (WMPs). These investors are very sensitive to changes in both financial factors (such as interest rates) and the economic decisions coming from Beijing. Any indications of instability could quickly lead to a withdrawal of this source of liquidity from the private sector and a potential credit crisis throughout the economy – affecting banks, personal loans, and corporates that have relied on private credit. The past week has shown an alarming rise in interest rates and a shortening of duration in the WMP market, indicating a high degree of nervousness among private investors. wmp-liquidity

Quick Thoughts on Timing of China’s Debt Crisis

| China’s Crisis

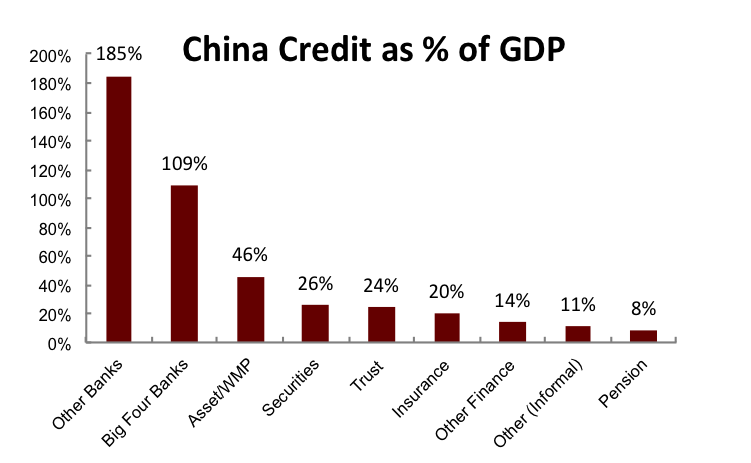

Timing? I’ve been getting questions recently on when China may hit the crisis point.Timing for a crisis is always tricky. The short answer — no catalyst yet. I see three parameters: 1) The amount and type of credit at risk. 2) The state of the fundamental economy. 3) General “perception” among individuals. On the first question, the chart below has a breakdown of credit. For the past few years, Trusts and WMPs have been the most risky, in the sense that they are short-term and high interest rates. However, this credit is disbursed among many different lenders. Recently, as you know, other banks have increased their exposure. I would argue there are two risks — an interbank risk of defaults and a general run on liquidity from private sources. What would trigger any of these? 1) Defaults in the shadow market. Private investors could quickly pull out of these investments, causing a liquidity crisis among borrowers, including LGFVs, private corporates (mainly property developers), and ultimately governments that can no longer sell land at a premium nor earn income from property-related fees. This is what the recent court case on a trust default may be implying. 2) A single “other” bank suffers a bank run because of a local credit event. This could either cause a chain reaction in the interbank market or lead to a crisis in confidence across a number of investment classes. Is there any sign of this? The fact that private investors are withdrawing cash from their assets in Fujian is a negative sign. We don’t know if this is widespread. Fujian traditionally has been very quick to react to the economy because of its free market orientation. Other than that, the default of the Trust product was certainly interesting and should be watched closely. Will this investment be allowed to default? Will a bank step in? Will there be others? I would expect an increase in “liquidity events” in 2017. It could be that the PBOC/CBRC will step in to recapitalize failed parts of the system, like an octopus regenerating a cut limb. However, if too many limbs are injured, the octopus runs out of protein supplies. Beijing can only recapitalize by issuing government bonds, increasing Central Bank Repos, or expanding state bank balance sheets. But then it has to distribute this credit and also it will be squeezed overall. China can’t accept on its balance sheet the expansion of credit to the tune of 200% of GDP over the past decade or it would be among the most indebted countries in EM in the globe. |

China Oceanwide: Synergies with Genworth Financial

China Oceanwide Holdings Group Co., Ltd. (715 HK) announced in October it plans to acquire 100% of the outstanding shares of Genworth Financial Inc. (GNW NYSE). The purchase will be made through its affiliated company, Asia- Pacific Universe Investment, for US$5.43 per share in cash, 4.2% more than the closing price of the date of announcement, for a total amount of US$2.7bn. In addition, China Oceanwide pledged to provide US$600mn to Genworth to pay down debt maturing in 2018, as well as US$525mn to strengthen its life insurance business. The deal is expected to be completed by the middle of 2017. The direct investment of insurance premiums into overseas financial markets not only lowers the cross-border transfer costs for property companies that want to expand overseas, but also allows them to avoid the pressure of short-term debt given the relatively longer life span of most insurance projects and a steady stream of funding provide.

Notes from China: Privatizing Debt

We just returned from a trip interviewing banks and local lenders in Fujian Province and Shanghai. These local lenders include pawn shops, private families, and small businesses. They provide short and medium-term loans to consumers. Two points jumped out: 1) Consumers are leveraging up by withdrawing equity from their assets, mainly property and autos. This is a negative indicator for China’s economy. 2) Banks and other non-bank are drawing capital from these private individuals to fund government projects. This is a fiscal stimulus actively encouraged by the government.

Bloomberg Radio:

Andrew Collier, Managing Director, Orient Capital and Senior Fellow, Mansfield Foundation joined Yvonne Man and Bryan Curtis to discuss the APEC meeting and the outlook for the Chinese economy.

Collier is skeptical about Chinese growth and also argues that the Chinese may pull back from the use of the military in the South China Sea if it sees advantages in trade as the U.S. raises tariff barriers.

Running time 06:46

http://www.bloomberg.com/news/audio/2016-11-21/china-happy-to-take-advantage-if-u-s-pulls-back

CNBC: China Data and the Trump Effect

http://video.cnbc.com/gallery/?video=3000567689&play=1

The Politics of the Syngenta Deal

Will Chem China Get its Money?

We’ve been doing some work recently on the proposed Chem China acquisition of Syngenta. The documents submitted so far are woefully inadequate, forcing investors to rely on press reports from Caixin Magazine in Beijing. That has left many investors scratching their heads figuring out if the financing is solid. As they note, “ChemChina intends to finance the Offers with funds borrowed through credit facilities entered into with HSBC Bank plc, as facility agent, and China Citic Bank Corporation Limited, respectively. “ More important, the offer is not subject to last minute “financing conditions.”

The phrase that is most striking in the press reports is “underscoring the government’s lack of enthusiasm is the fact that none of the four largest state-owned banks has joined” the lenders.

Caixin, an independent magazine in Beijing, is generally quite reliable (admittedly I am biased as my daughter worked there two years ago). But they are short-staffed and don’t always cover business thoroughly. And sometimes they are motivated by their political backers who reach into the highest levels of government (I can’t say in print who they are…) . Are they reliable here? My gut tells me no – but it doesn’t mean the magazine is correct in assuming that there is no support for the deal. Let me explain.

It is true that a large loan commitment from the state banks generally would be a sign of approval from higher channels, primarily the State Council that pulls the strings on the more sensitive, and expensive, decisions. However, I also know from recent meetings with bankers in Beijing in October that there is increasing reluctance among the state banks to lend to state-owned corporations, even large ones. The banks have been used as a channel for many of China’s investment plans, and they are getting concerned that they will be forced to absorb losses from defaulting state firms – which the banks would prefer to push them back to the central bank, the Ministry of Finance, or local governments. Some banks even have an informal quota for loans to key sectors such as rail because of excessive investment abroad by China Rail and other state firms. So lack of support from these banks per se doesn’t indicate lack of political support generally.

My estimation, after carefully reading the documents, is that there is tacit permission from the leadership for the deal – but no one will commit unless it is confirmed. It’s too risky to attach one’s name to a transaction of such size, global importance, and cost, that could fail. What seems clear is that, having completed 100 acquisitions, Chem China Chairman Ren Jiang is known as a guy who can get deals done. But he’s also known as a person who often stretches his connections and financing to the limit.

Can he complete the financing for the Syngenta transaction? The center of the financing is China Citic Bank in Beijing. China Citic Bank has signed an undertaking for the majority of the financing, around $30 billion, with plans to offload at least $15 billion to others. But there are some red flags here. First, Citic’s own balance sheet is becoming riskier. Property investment jumped to 27.4% of corporate loans in 1H 2016 from 24.2% in 1H 2015. This is a sector that is on shaky ground due to an exploding property bubble. Elsewhere, although interbank placements fell a marginal 4.7% YoY, the short-term portion (under one month) jumped 27.6%, suggesting growing nervousness in the interbank market.

The biggest issue is how and if Citic offloads the $15 billion into the private sector through the shadow banking market. They would do this by selling pieces of the loan to private investors in the form of China’s famous “Wealth Management Products” (WMPs). These are….well…more or less anything the buyer will accept. Citic could bundle them with other products, or sell them directly as part of the Chem China deal. They are supposed to be transparent but the banks have been skirting these rules.

What would a batch of WMPs mean for the deal?

- First, there would be a lot of interested parties holding pieces of Chem China in the form of a non-fungible equity investments. Exiting may not be easy for them and they may become a political force with unknown consequences.

- Second, Citic would have to offer a relatively high interest rate to convince buyers to acquire these WMPs, putting pressure on Citic’s balance sheet, and in turn, on the Syngenta deal itself.

- Third, at this stage it looks like these investments would be channeled through six SPVs that are being established offshore. It’s doubtful Citic could raise this capital offshore from the private market. There’s little appetite for dubious WMPs among offshore investors. There is the possibility of institutional investors coming in but it seems more likely they would buy shares in Syngenta directly. If this capital is sourced from Chinese investors on the mainland, how would they get the capital offshore? Citic would not be able to convince the PBOC/SAFE to allow this much money to move into a speculative offshore investment, particularly since SAFE is clamping down on all international transactions. It would be up to the individual investors to arrange the currency conversion – possible but increasingly difficult.

We still think the transaction will be financed and approved. But there are complications that have to be conquered before completion.

ChinaChem/Syngenta Deal – How Will it Be Funded?

Orient Capital Research

Hong Kong, October 17, 2016

China Chem & Syngenta

In August, the U.S. approved China National Chemical Corp.’s proposed $43 billion takeover of Swiss seed company Syngenta AG, overcoming domestic opposition on security grounds. Given the history of Chinese foreign acquisitions, one of the concerns remains the ability of ChemChina to raise the funds for the proposed purchase. In this note, we analyze several sources of capital and the political implications of the financing behind the deal.

1. Chinese Merger Examples. One of the plans under discussion is that China Chem, Sino Chem and an unknown third party will together invest in an initial SPV (Special Purpose Vehicle) for China Chem’s acquisition of Syngenta with an estimated total amount of US$15bn. Although both companies — along their subsidiaries — denied this speculation, the market believes this deal is a replay of the merger between CNR and China South Locomotive as well as China COSCO and China Shipping Group. These, however, were domestic, not international, mergers.

2. Equity Financing from a Government Fund. There is also speculation that China Chem is also considering a new financing structure (equity financing). The major source will be provided by SASAC (State owned Assets Supervision and Administration Commission, which controls state firms) and the government-funded Silk Road fund for US$10bn.

3. Possible All Cash Offer. Some analysts think ChinaChem will first do some restructuring to lower the leverage given a high debt ratio of 80%. By the end of 1H16, ChinaChem had a total debt over Rmb300bn. The acquisition (US$43bn) of Syngenta would also feature significant leverage, including a three-layer financing structure, with Chinese and international components, including six SVPs. However, bankers in China claim that China Chem has already clarified the source of capital for this acquisition in its tender offer: “This is a cash offer and has nothing to do with China Chem and its subsidiaries’ financials,” one banker told us.

4. Anti-Monopoly Investigation. The U.S. CFIUS approval may need to be revisited due to a potential cooperation between ChinaChem and SinoChem. According to one Chinese mergers lawyer, “If the integration between ChinaChem and Sino Chem started before the acquisition, the recently approved anti-monopoly investigation may need to be redone, given the changes that happened in the agreement. It will be harder to get approval by CFIUS this time as the agrochemical and chemical businesses of SinoChem will be included this time. Before, China Chem and Syngenta have few overlapping in terms of agrochemical and seed businesses.”

5. Anti-Gene Transplant Sentiment Within China. ChinaChem’s acquisition of Syngenta was delayed for the third time, mainly due to Syngenta’s transgenic technology. From the very beginning, the former head of the State Ministry of Chemical Industry and an additional 400 people petitioned against the acquisition. According to the media, this number has grown to more than 1,300.

6. Preferred Stock is One Option. Since 2006, ChinaChem has conducted a few overseas acquisitions, which almost eliminated its cashflow. This time, ChinaChem plans to sell preferred stock and bonds to raise money. According to CITIC bank, the first-layer capital raising of US$12.7bn was successfully completed in June, 20% more than expected. However, CITIC bank has been silent regarding the second-round financing. Someone familiar with the acquisition told media that ChinaChem was going to sell the preferred stock in one of its units in exchange for US$10bn, of which half of the preferred stock would be convertibles. The remainder consist of bank loans

7.Strong Government Support. From a strategic viewpoint, it is highly likely the government will support this acquisition because in the long run it will improve China’s current agricultural technology in a meaningful way. In addition, the market expects that the Chinese government might start a new round of industry consolidation upon the completion of this acquisition.

For further analysis, please contact Orient Capital Research to discuss additional projects. andrew@collierchina.com

CNBC Interview: China Postal Savings Bank IPO

http://video.cnbc.com/gallery/?video=3000555009&play=1