| China’s Crisis

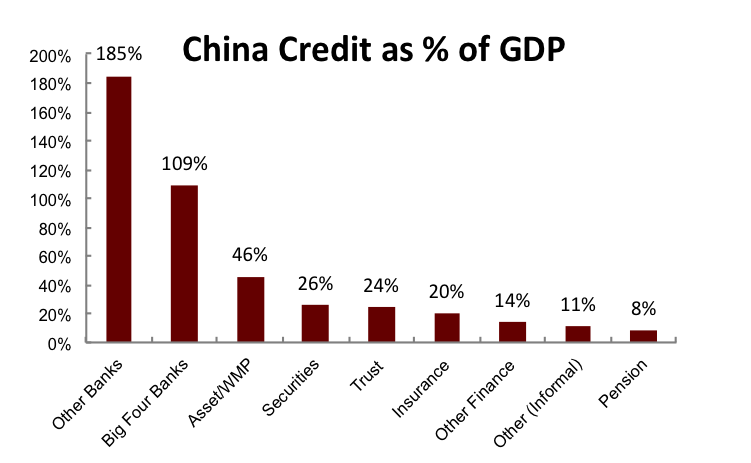

Timing? I’ve been getting questions recently on when China may hit the crisis point.Timing for a crisis is always tricky. The short answer — no catalyst yet. I see three parameters: 1) The amount and type of credit at risk. 2) The state of the fundamental economy. 3) General “perception” among individuals. On the first question, the chart below has a breakdown of credit. For the past few years, Trusts and WMPs have been the most risky, in the sense that they are short-term and high interest rates. However, this credit is disbursed among many different lenders. Recently, as you know, other banks have increased their exposure. I would argue there are two risks — an interbank risk of defaults and a general run on liquidity from private sources. What would trigger any of these? 1) Defaults in the shadow market. Private investors could quickly pull out of these investments, causing a liquidity crisis among borrowers, including LGFVs, private corporates (mainly property developers), and ultimately governments that can no longer sell land at a premium nor earn income from property-related fees. This is what the recent court case on a trust default may be implying. 2) A single “other” bank suffers a bank run because of a local credit event. This could either cause a chain reaction in the interbank market or lead to a crisis in confidence across a number of investment classes. Is there any sign of this? The fact that private investors are withdrawing cash from their assets in Fujian is a negative sign. We don’t know if this is widespread. Fujian traditionally has been very quick to react to the economy because of its free market orientation. Other than that, the default of the Trust product was certainly interesting and should be watched closely. Will this investment be allowed to default? Will a bank step in? Will there be others? I would expect an increase in “liquidity events” in 2017. It could be that the PBOC/CBRC will step in to recapitalize failed parts of the system, like an octopus regenerating a cut limb. However, if too many limbs are injured, the octopus runs out of protein supplies. Beijing can only recapitalize by issuing government bonds, increasing Central Bank Repos, or expanding state bank balance sheets. But then it has to distribute this credit and also it will be squeezed overall. China can’t accept on its balance sheet the expansion of credit to the tune of 200% of GDP over the past decade or it would be among the most indebted countries in EM in the globe. |